Secret “424(k) Accounts” Helping Create Retirement Millionaires?

Dear Friend,

Even though they could help save us from a retirement crisis, they are never advertised…

They have nothing to do with regular stocks, bonds, options, annuities, or anything else like that.

But word of what we call “424(k) Accounts” is spreading.

Investors and corporate insiders have tapped into them…

Ray* went small. We figure he was declared $3,567 over a one-year period from his “424(k) Accounts.”

Bruce* went bigger. If he stayed in his plan after he got in, we estimate he was declared about $2,550 per month over a one-year period from his "424(k) Account" plan.

The thing is that you too could open up a “424(k) Account” starting with as little as $25.

424(k)s Could Pay You 8 Times More Than Ordinary Dividends?

The dividends on the common shares of big public companies are yielding about 1% to 3% right now, if they pay a dividend at all.

For most, I’m certain that’s not enough return on investment to retire on.

But that’s not the case with what we’ve dubbed “424(k) Accounts.”

In fact, I’ve found some of America’s biggest companies paying investors in these accounts multiple times more than their regular dividends!

And this is a fixed agreement…

Which means you know exactly how much you make going in…

Your principal is substantially safer than it is in common stocks…

You can withdraw your money at any point…

And your payouts often flow in monthly…

One pays…

8 times more than the average S&P 500 dividend.

I’ve identified over 100 big American companies offering this program…

As Forbes writes, “…when it comes to creating retirement income, [they] are among the most underutilized investments that can help remedy the situation.”

And USA Today says they “can be a lucrative source of cash…” but…

“…investors need to know how to dig deeper to find out about these widely-available but less obvious corporate investments.”

That’s why I’ve done the digging for you.

And what I’ve found is that it couldn’t be easier!

In order to open a “424(k) Account” today…you need three things:

A brokerage account

$25 to start with

The names of the best 424(k) companies to get into

Over the next few minutes, I’ll reveal more about what we call “424(k) Accounts…”

I’ll share with you some of the companies that are paying investors 108%, 222%, 338%, even 421% more in “424(k) Account” payments than they are paying in regular dividends.

But first, allow me to introduce myself…and how I uncovered these “424(k) Accounts.”

My Biggest Income Discovery Yet

My name is John Whitefoot, BA.

I’ve spent my adult life immersed in the financial markets…uncovering obscure, highly lucrative investment ideas you likely won’t hear about on CNBC or in The Wall Street Journal.

It’s this mission that ultimately took me to my position as a senior analyst at Lombardi Publishing Corporation—an independent investment research firm that’s just celebrated its 37th year in business.

Here I have the freedom to show my readers what I believe are the most lucrative income deals…

But in all my years in the markets, I’ve never come across anything quite like what we’ve labeled “424(k) Accounts.”

If you’re retired or near retirement and need fixed, reliable income streams from your investments to pay for your expenses…

Then “424(k) Accounts” could be what you’ve been waiting for.

You see, if you’re like most investors and own blue-chip stocks or mutual funds…

…you’re likely, at best, collecting ordinary dividends that yield 1, 2% or 3% on your investment.

But as incredible as it sounds, some of these same blue-chip companies are solid, safe household American names. In fact, one pays 12 times as much as its regular dividend!

What Exactly Are “424(k) Accounts?”

And why do they pay so much?

“424(k) Accounts” are a $272-billion niche of the market.

That’s a whole lot of cash hiding in plain sight.

But there’s nothing really complicated or dark about how they operate or why they exist.

There’s no catch when it comes to “424(k) Accounts.”

When public companies need to raise money for a new project, expansion, or acquisition…they need financing from investors.

Some companies won’t do this with ordinary shares because the more shares they issue, the lower the worth of all the shares becomes. It’s called dilution.

(That’s why you’ll rarely see Warren Buffett issue new shares of Berkshire Hathaway to buy a company.)

Thus the invention of a form of what we call “424(k) Accounts” in the 19th century.

Railroads, electric companies, and oil rigs started using them to attract heavyweight investors.

And the Robber Barons loved them because it allowed them to attract other big investors—without diluting control of their beloved companies.

That’s why legendary names like…

Ford…

DuPont…

Mellon…

…and Rockefeller…

…each used “424(k) Accounts.”

As USA Today reports:

“…[they] have been around since the late 1800s and have been a key holding for many old-money families.”

And the Chicago Tribune even calls them “an upper notch in the investor pecking order.”

Now, all of this would be nothing more than just interesting history…or nice to know what the big guys are doing…if it wasn’t for one simple fact:

They aren’t advertised.

Let me show you a few examples of how they work…

$1,008 from This Mortgage Company

A major mortgage investment trust offered a “424(k) Account.”

It costs less than $20 to start—the going rate for some of these plans.

And investing $5,000 would have returned you a gain of $1,008 over two years.

After the payments, you could have asked for your $5,000 back or kept getting more payments.

Not a bad deal, I’d say. In fact, it’s about a 20% return. Who gets that with regular dividends?

And you didn’t have to invest $5,000. You could put in less or more. Again, it’s up to you.

And remember, these “424(k) Accounts” are as close to safe as it gets.

I can’t stress that enough. In the stock market, nothing is guaranteed. Not your dividends. Not your principal.

In this case, you know exactly how much you’re going to make going in.

Here’s another reason why this is so much better than stocks…

You Could Be Protected if the

Stock Market Plummets

Let’s look at this example.

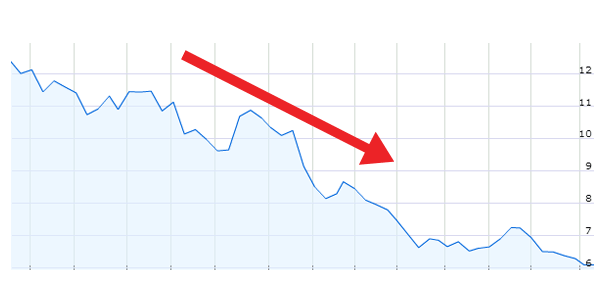

Years ago, the stock of a large American shipping company was trading for around $12.

So you could have purchased 800 shares for $9,600.

Here’s what happened next…

The stock dropped to $6 in about a year's time. Your $9,600 holding would have only been worth $4,800.

A crushing 50% loss.

That’s awful.

But during the exact same time period, the company offered “424(k) Accounts.”

If your $9,600 was in their “424(k) Account” instead of their common stock, you could have actually been paid about $850; that’s a 9% return on your money while the company’s common stock declined 50%!

What’s more, you wouldn’t have lost a cent of your principal.

Here’s another one…

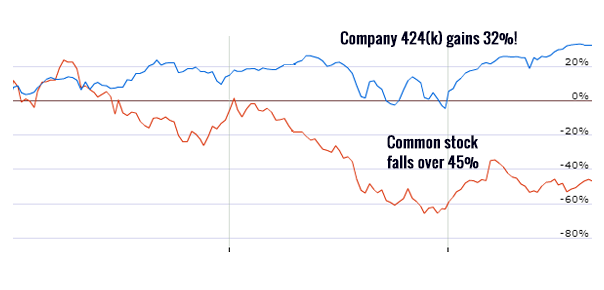

This investment bank was rocked coming out of the Great Recession of 2009, and over the course of 31 months, its stock price dropped by over 45%.

If you invested $100,000 into the company’s common shares, you’d have lost nearly $46,000…

On the other hand, if you’d taken that same $100,000 and put it into the company’s “424(k) Account,” you’d have preserved all your capital…

And received over $16,105 in payouts!

All told, you could have potentially walked away with your original investment, plus $16,105!

How to Add Your Name to

a “424(k) Account”

The great thing about “424(k) Accounts” is that you could buy them through most brokerage accounts…

You need as little as $25 to start and then it is up to you how much you want to invest.

But you can’t just close your eyes and blindly pick any 424(k)!

It’s important to be selective.

Because the company that offers the plan is of utmost importance.

So are their status and “investment grade.”

That’s why I’ve put over 100 of these company-offered “424(k) Accounts” plans through a screening process…

And using my criteria, I’ve narrowed my selection down to just three “424(k) Accounts” offered by some of America’s biggest and most profitable companies.

In my special investor research report, 424(k) Accounts: America’s Secret Retirement Income Plans…

…you’ll find the names of these three companies and all the important information on their plans…

…plus, my “424(k) Accounts” strategy showing you how to build a large, safe 424(k) portfolio.

Access Your Free Report

within 48 Business Hours

We value this report at $95.

But the great thing I haven’t mentioned yet is that you won’t be charged for my research report, 424(k) Accounts: America’s Secret Retirement Income Plans.

It’s yours with my compliments.

All I ask is that you take a subscription to my financial advisory newsletter, Passive Monthly Income.

Let me say right off the bat that Passive Monthly Income is perfect if you’re a few years away from retirement or already retired for good reason.

Being a senior analyst at Lombardi Publishing Corporation for years now…

…I’ve been privy to the kind of sensitive financial information most people have never heard of.

424(k) Accounts are just one good example.

With Passive Monthly Income, I filter those kinds of income ideas to individuals like you, because:

I know how difficult it is for folks to build a real nest egg with which to live comfortably during their golden years, as most investments are vulnerable to economic downturns.

I believe that worry-free retirement can only be achieved with investment vehicles that have a long track record of paying out rising income…often immune to market turmoil.

These two factors are the building blocks on which Passive Monthly Income is founded.

Retire Comfortably Without Worry?

Let’s face it: You need income ideas that are the most immune to the volatility of the stock market, the economy, and world economies.

Investors watched over $15 trillion disappear during the Credit Crisis of 2008 and 2009.

About $2 trillion belonged to the retirement savings accounts of Americans. And according to The Washington Post, it all evaporated in just 15 months.

And that’s why we created Passive Monthly Income.

It’s the only investment research service I know of that’s focused on income ideas that in the past kept paying regardless of what happened in the market and the economy.

In each monthly issue, I discuss income ideas that have longevity and successful track records of returns often of a minimum of 25 years.

But apart from the blue-chip “424(k) Accounts,” there are other secure, high-paying income plays churning out solid dividends that I recommend in Passive Monthly Income.

And here’s the best part…

The average return on my Open Portfolio of 35 picks in Passive Monthly Income is a whopping 60.4%!

Yes, that’s a 60.4% profit from safe income investments!

And if I like a pick, I stay with it. My average hold period in my open portfolio is just over four years.

And that doesn’t even include the dividends my picks pay out during each year!

Now, I want to make this perfectly clear:

While my track record sounds phenomenal…

…there’s no guarantee that every one of my recommendations will make money.

Past performance is no guarantee of future results, and all investments—no matter how safe they sound—have some form of risk.

That said…

Through Passive Monthly Income, you will get income ideas from companies in highly regulated markets that have proven in the past to remain immune to economic downturns.

That’s why I want to send you my research report, 424(k) Accounts: America’s Secret Retirement Income Plans, with my compliments.

In return, all I ask is for you to try Passive Monthly Income.

Here’s Everything You Get

Once your membership is activated, you’ll get:

12 monthly issues of Passive Monthly Income (that’s one year of service): Each packed with safe, income-making ideas.

Full access to my income portfolio: Besides 424(k)s, you’ll have access to the other dividend plays, rising income plays, and royalty check programs in my portfolio.

Action alert emails, when I believe they are necessary to send out: These quick emails are designed to help you maximize your profits on income investments I have recommended.

Now here’s the best part.

Lombardi’s monthly financial advisories range in price up to $1,995 a year.

We’ve sold Passive Monthly Income for years at the annual rate of $295—that’s 12 monthly issues, plus email alerts.

But in light of the retirement crisis hitting investors today, I know every dollar counts.

That’s why I want to do better than that for you!

Your rate when you order today is $100 off the regular price: you pay only $195.

Yes! $100 off the regular annual price!

And it gets even better…

If I don’t deliver the profits I claim to and more from low-risk income investments, or if you are not satisfied for any reason…

…let us know by phone, at our website, email, or regular mail anytime during your one-year 12-issue subscription and we’ll send you a refund on your undelivered issues.

Of course, the special report, 424(k) Accounts: America’s Secret Retirement Income Plans, is always yours to keep with my compliments.

This guarantee is backed by our company, in business for 37 years now and having served over one million customers in 141 countries!

I can’t be fairer than that.

And one last thing…

Very few people ever cancel once they start with Passive Monthly Income.

With the average return on my Open Portfolio of picks in Passive Monthly Income up a whopping 60.4%…

…all from safe income investments (and that doesn’t even include the big dividends my picks pay)…

…why would anyone not continue with Passive Monthly Income?

But now it’s your turn.

Today, you’ve seen insiders use “424(k) Accounts” to add to their income.

While it would be wrong to tell you exactly how much you could collect “424(k) Accounts,” because that will solely depend on how much you invest in your plan, one thing is certain.

You have to get your name added to a plan to get started.

Click the link below. It will take you to our secure order page where you can read a summary of everything I’ve just said before you place your order.

Don’t waste another moment on this.

Click the link below now!

Sincerely,

John Whitefoot, BA

John Whitefoot, BA

Editor

Passive Monthly Income